As with an income statement, the statement of cash flows reflects a company’s financial activity over a period of time. It shows where a company’s cash comes from and how it’s used to pay for operations and/or to invest in the future. Given the complexity of some financial statements, it may help to create a separate schedule to calculate the changes in NWC.

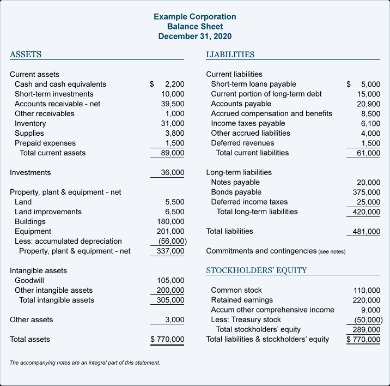

The cash balance from the cash flow statement at the end of the period becomes an asset in the balance sheet, indicating its worth to stakeholders and investors. The financial statements are used by investors, market analysts, and creditors to evaluate a company’s financial health and earnings potential. The three major financial statement reports are the balance sheet, income statement, and statement of cash flows. Although this brochure discusses each financial statement separately, keep in mind that they are all related. The changes in assets and liabilities that you see on the balance sheet are also reflected in the revenues and expenses that you see on the income statement, which result in the company’s gains or losses. Cash flows provide more information about cash assets listed on a balance sheet and are related, but not equivalent, to net income shown on the income statement.

Índice

AccountingTools

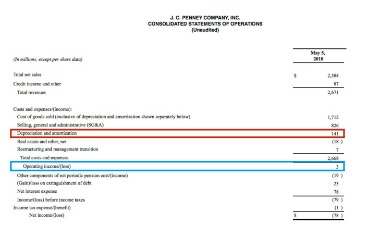

An income statement summarizes a business’s profitability and financial results for a period. This financial report shows what it costs to create your products and services and keep the business running. It is handy to compare how an organization’s revenues increase or decrease over multiple periods. This article aims to answer all your frequently asked questions about financial statements. We’ll define what they are, share why they are essential, and introduce three primary financial statements you need to keep your business going.

Find out each statement’s purpose, financial statement parts, and formulas. Financial statements are critical tools for evaluating the financial health of a business. They provide a snapshot of a company’s financial position, performance, and cash flow.

Operating Activities

It links your profit & loss (income statement), balance sheet, and cash flow projections together so you can forecast your company’s financial health and future cash position. The three-statement model links your company’s income statement, balance sheet, and cash flow projections together so you can project your future cash position and financial health. The cash flow statement then takes net income and adjusts it for any non-cash expenses.

Spotlight: the IPO process in India – Lexology

Spotlight: the IPO process in India.

Posted: Mon, 04 Sep 2023 16:21:08 GMT [source]

Cash flow statements are really good for helping business owners and managers find areas to improve. Income statements can be used to identify revenue and expenses, evaluate profitability, provide information to stakeholders and plan for the future. But together, they can provide powerful, insightful data for a company and its investors. Net income is the top-line item in the cash flow statement’s “operations” section. Running a stable and successful business requires understanding, creating, and sharing accurate financial statements with partners, organizations, and relevant authorities that govern and work in your industry.

You can use income and cash flow statements and balance sheets to monitor financial health in a way that just isn’t possible otherwise. When reviewing an income statement, you’ll find information linked to any assets, liabilities, equity, owners’ investments and distributions to owners. It also includes revenues, expenses, gains/losses and comprehensive income.

Cash flow from investing

These three core statements are intricately linked to each other and this guide will explain how they all fit together. By following the steps below, you’ll be able to connect the three statements on your own. Diane Costagliola is a researcher, librarian, instructor, and writer who has published articles on personal finance, home buying, and foreclosure. Schwab does not recommend the use of technical analysis as a sole means of investment research. All expressions of opinion are subject to change without notice in reaction to shifting market or economic conditions.

The balance sheet reports a company’s financial health through its liquidity and solvency, while the income statement reports a company’s profitability. A statement of cash flow ties these two together by tracking sources and uses of cash. Together, financial statements communicate how a company is doing over time and against its competitors. After spreading the cost evenly over the three equipment’s asset useful life’s (this is called “straight-line deprecation”), total D&A for each of the five years can be summed.

The Three Major Financial Statements: How They’re Interconnected

The “charge” for using these assets during the period is a fraction of the original cost of the assets. It’s the money that would be left if a company sold all of its assets and paid off all of its liabilities. This leftover money belongs to the shareholders, or the owners, of the company. If you can read a nutrition label or a baseball box score, how insurance works you can learn to read basic financial statements. If you can follow a recipe or apply for a loan, you can learn basic accounting. Nonetheless, the balance sheet is of considerable importance when paired with the income statement, since it reveals the amount of investment needed to support the sales and profits shown on the income statement.

- There are a variety of ratios analysts use to gauge the efficiency of a company’s balance sheet.

- It is an important final account of a business which shows the summarized view of revenues and expenses for a particular accounting period.

- When predicting possible pitfalls and hiccups that might come up down the road, a cash flow statement can help you do this, too.

- This brochure is designed to help you gain a basic understanding of how to read financial statements.

The three core statements are the income statement, balance sheet, and cash flow statement. Together, they create a picture of a company’s financial condition that is useful to stakeholders as they read financial statements. Changes in current assets and liabilities on the balance sheet are reflected in the revenues and expenses that you see on the income statement. Cash flows provide additional information about cash assets listed on a balance sheet and are also related to the net income line of the income statement.

And information is the investor’s best tool when it comes to investing wisely. In summary, the simplest approach to understanding the linkage between the three financial statements is to follow net income. Net income is also utilized to calculate retained earnings on the balance sheet.

- Most firms prepare their Statement of Financial Position as at the 31st of December each year.

- You don’t want to report incorrect information to the government when you file a small business tax return.

- You can create a balance sheet at the end of a period, such as monthly or quarterly.

Finally, these financial statements can help you attract and keep new talent. After all, not many top-of-the-line employees are going to want to work for a business drowning in debt. A cash flow statement depicts the sources and uses of a company’s cash and equivalents, which is very important information for stakeholders.

This data is reviewed by management, investors, and lenders for the purpose of assessing the company’s financial position. The amount by which assets exceed liabilities is listed as total shareholders’ equity, and this represents the net worth of a company, or the book value of the stock. Shareholders’ equity includes common stock, additional paid-in capital, and retained earnings.

Deixe um comentário